FTA announces Corporate Tax Registration Deadline – 90 days from Date of Incorporation/MOA. AED 10k penalty for late registration.

When you shift to or establish a business in the UAE, you enter a world-renowned for its favorable tax environment. However, handling the rules of global taxation needs official paperwork, and that is where the TRC certificate Dubai and the tax domicile certificate in the country come into the picture.

If you have begun researching, you have potentially witnessed these two terms utilized almost interchangeably, which can be confusing. The simple, vital fact is this – in the country, the tax residency certificate and the tax domicile certificate are crucially the same document. The FTA (Federal Tax Authority) is the body responsible for granting this single, official certificate.

The UAE tax residency certificate, also usually known as a tax domicile certificate UAE, is an official document granted by the Federal Tax Authority. Its major work is to formally verify that an individual or a corporation is a tax resident of the United Arab Emirates for a particular duration.

Consider it your official tax resident ID card. This certificate is your legal evidence to foreign tax authorities and financial institutions that your major tax home is the United Arab Emirates.

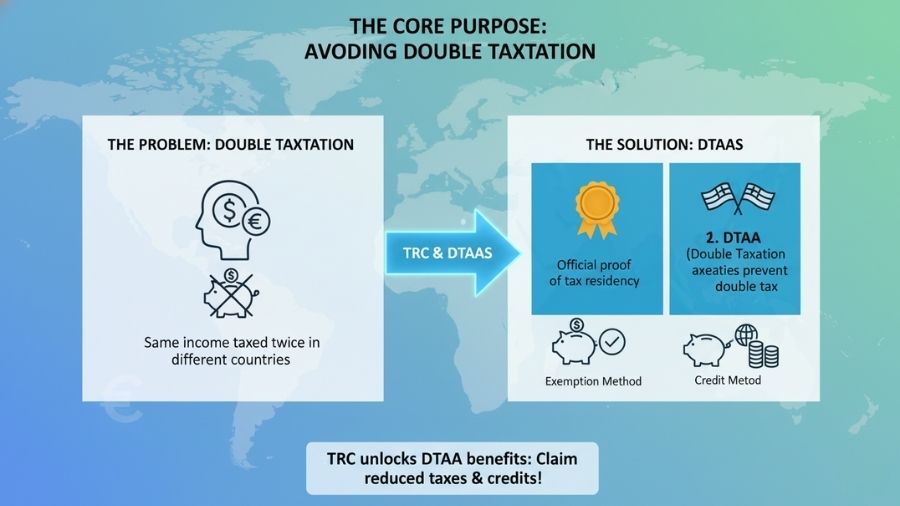

The single most crucial reason to acquire a TRC certificate Dubai or anywhere in the United Arab Emirates is to take advantage of the huge network of Double taxation avoidance agreements that the UAE has signed with more than 130 nations globally.

1. Double Taxation – This occurs when two different nations claim the right to tax the same income you have gained. For instance, if you reside in the United Arab Emirates but get dividends from a corporation in a foreign country, both the source nation and your nation of residence may want to tax that income.

2. The TRC Solution – By presenting your TRC certificate UAE to the tax authority of the foreign country, you deliver the crucial evidence of your UAE tax residency. The DTAA between the UAE and that country then kicks in, permitting you to claim an exemption or a decreased withholding tax rate in the overseas country. This controls you from being taxed twice on the same income.

Shortly, whether you call it a TRC vs tax domicile certificate, its major task is to deliver the legal foundation for you to take advantage of these international tax treaties.

The eligibility standards are transparently described by the Federal Tax Authority for both persons and companies.

For Person –

To be eligible for a person’s UAE tax residency certificate, you should fulfill the following criteria –

1. Valid Residency – You should hold a legal UAE residence visa and an Emirates ID.

2. Duration of Stay – You should have been a resident of the United Arab Emirates for a minimum of 183 days within the appropriate tax year.

3. Physical Presence and Interests – You should be capable of proving your tax domicile in the United Arab Emirates. This means having a permanent place of residence and proof that your financial and personal interests are focused in the United Arab Emirates.

For Companies –

For a corporation to make an application for a TRC certificate UAE, it should fulfill these necessities –

1. Duration of Existence – The company should have been formed and functioning in the United Arab Emirates for at least one year.

2. Functional Presence – It should have a legal trade license and a running physical office or formation in the United Arab Emirates.

3. Financial Records – Corporations are typically needed to deliver audited financial records for the appropriate financial year.

4. Exclusions – Usually, offshore corporations aren’t eligible for the TRC as they aren’t deemed formed within the tax system of the UAE for DTAA purposes.

The application procedure for the TRC certificate UAE is managed electronically through the Federal Tax Authority portal.

1. Preparation – Collect all your crucial documents, which comprise your passport, Emirates ID, residence visa copy, a broad entry and exit report from the General Directorate of Residency and Foreigners Affairs, bank records, and your tenancy contract/property deed. For corporations, you will need the business license, audited financial records, and the lease contract.

2. Submission – Make an application online through the official platform of FTA. You will choose the particular country and the financial year for which you demand the certificate.

3. Review and Approval – The FTA reviews the Application and all supporting papers. The procedure usually takes a few weeks.

4. Issuance – Once sanctioned and the application cost is paid, the Federal Tax Authority gives the official tax residency certificate.

The TRC certificate UAE is usually legal for a duration of one year from the beginning of the financial year for which it is given. It is crucial to note that you should re-apply yearly to sustain your financial status and continue taking advantage of the DTAAs.

To put it simply –

1. Tax Domicile Certificate = TRC Certificate

2. UAE Tax Residency Certificate = TRC Certificate Dubai / UAE

These are different names for the same important document that the FTA released. The cornerstone of UAE international tax planning is this certificate.

Getting this document is not merely an administrative chore; it is a strategic requirement for any person or company with financial interests outside of the United Arab Emirates. Arabian Wingz emphasizes that it acts as your official proof of residency, lowering the possibility of an unjust double taxation and enabling you to invest and conduct business internationally with confidence. Getting your UAE tax residency certificate should be your first priority if you earn money from abroad.