FTA announces Corporate Tax Registration Deadline – 90 days from Date of Incorporation/MOA. AED 10k penalty for late registration.

The UAE is a favorite destination for global entrepreneurs and companies due to its prime location and business-friendly rules.

Even after introducing corporate tax laws, the Emirati government made consistent efforts to strengthen its position as the primary choice among popular business hubs worldwide.

Establishing a business setup is easier in the nation compared to other Gulf nations like Saudi Arabia, but businesses are required to comply with existing laws to maintain legal operations. One such mandatory legislation is obtaining a UAE corporate tax registration certificate in UAE.

If you’re already running a business in UAE or planning to establish one and are still not aware of corporate tax registration and how to obtain a registration certificate, continue reading this blog.

This blog will clear all your confusion related to this mandatory legal requirement, like what it is, who needs to download it, and the steps to download it.

In June 2023, the UAE corporate tax law was introduced by the Emirati tax authority. This proved to be a major change in the nation’s tax guidelines, as it made corporate tax registration mandatory for almost all businesses operating in the UAE.

However, not only does this registration improve transparency, but it also supports businesses in multiple ways.

Issued by the FTA, the tax authority, a CTR is an official proof of a business’s legal physical presence and registration for the UAE corporate tax. When a company applies for corporate tax registration, the authority reviews the application along with the submitted documents and provides a unique TRN. This tax ID card helps businesses with:

Corporate Tax Registration is mandatory for all eligible businesses and individuals in the UAE. The CTR certificate is needed to access most public services in the country, including banking and licensing.

Every person or business that registers for corporate tax under the new tax rules introduced by the UAE’s tax authority needs to download a CTR certificate. The following are included:

Before learning the steps involved in downloading a corporate tax registration certificate in UAE, you must know the requirements that need to be met:

Under the new UAE corporate tax laws, CTR is now a mandatory legal requirement that every business with eligible taxable income needs to meet. Here is how you can download CRT certificate in four easy steps:

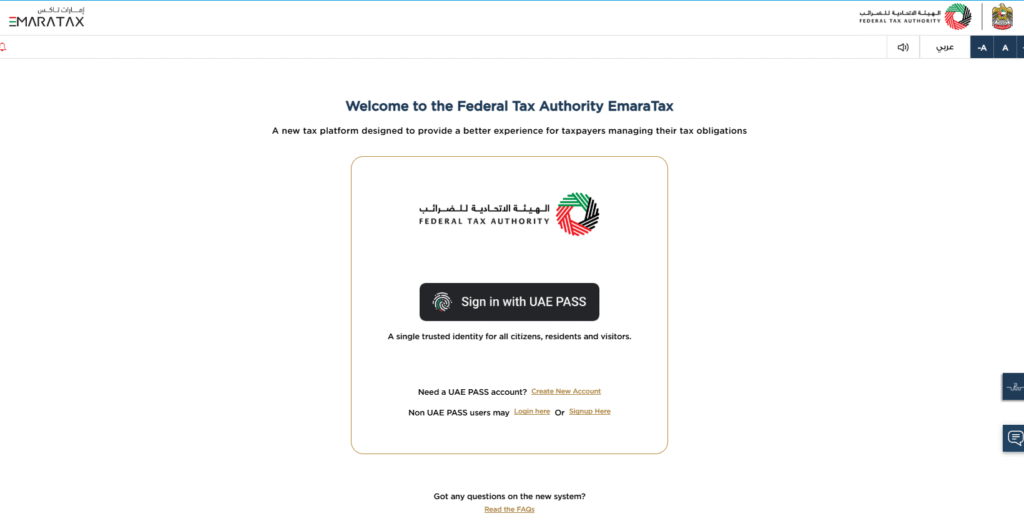

To get your CRT certificate firstly, you need to go to the EmaraTax portal and log in to your activated account with the provided account access details. This portal manages all tax-related tasks, like downloading important documents, such as a CRT certificate.

After you log into your account on the EmaraTax portal, go to the Tax Registration section. This section shows different tax options, and to download the Corporate Tax Registration certificate, you need to select the corporate tax option.

Under the Document section, you can easily find your Corporate Tax Registration certificate. But before downloading it, make sure your tax registration application gets clearance from the tax authority.

You won’t be able to download the CTR certificate if the application fails to meet the requirements.

After confirming approval status, download the CTR certificate in PDF format and save it securely on your device for future use.

Here are the three common challenges faced by businesses in downloading the CTR certificate with their solutions:

After successfully downloading the corporate tax registration certificate, you need to keep these three things noted:

Still, does the corporate tax registration certificate download process seem complex? Leave your worries; contact Arabian Wingz, a trusted name among the top-rated corporate tax consultants in Dubai.

Our experts understand all local and global tax-related rules and obligations. We are committed to helping our clients in navigating the changed UAE tax rules without hassles.

From corporate tax registration and filing tax returns to downloading a CTR certificate and support for tax audits, our team is available for every need. Connect Arabian Wingz to stay compliant with the UAE corporate tax laws always!

Question: How do I register for corporate tax in the UAE?

Answer: To register for corporate tax, visit the Federal Tax Authority’s EmaraTax portal and complete the registration process. Ensure you have all the required documents ready.

Question: What if I forget my EmaraTax portal password?

Answer: Use the “Forgot Password” option on the EmaraTax portal to reset your password. You can also log in easily using your UAE Pass.

Question: Can I download my Corporate Tax Registration Certificate immediately after registration?

Answer: No. You must wait for your registration to be approved by the FTA. Once approved, you can download your certificate from the EmaraTax portal.

Question: What should I do if I encounter technical issues while downloading my certificate?

Answer: Clear your browser cache or switch to a different browser. If the problem continues, contact Arabian Wingz UAE for expert assistance

Question: Is corporate tax mandatory for all businesses in the UAE?

Answer: Corporate tax applies to most businesses and commercial activities in the UAE. However, exemptions exist for free zone entities, small businesses under relief schemes, and government entities.

Also Read: What Is Benchmarking and Why Is It Important for Your Business?