FTA announces Corporate Tax Registration Deadline – 90 days from Date of Incorporation/MOA. AED 10k penalty for late registration.

In the fiercely competitive Middle Eastern business environment, company formation in Dubai has become one of the most alluring options for entrepreneurs looking to expand, innovate, and gain access to profitable regional markets. Understanding company formation in the United Arab Emirates necessitates navigating licensing zones, legal structures, and regulatory frameworks, regardless of your level of experience as an investor or an entrepreneur.

In this thorough guide, “How to Register a Company in Dubai?” Everything You Need to Know: we’ll explain critical compliance requirements like Anti Money Laundering UAE, guide you through every step of the company registration process, and show you how Arabian Wingz can help you launch a profitable business.

Dubai attracts global capital due to its strategic location at the intersection of the East and West, world-class infrastructure, and tax-friendly environment. Among the main benefits are –

1. Zero Personal and Corporate Income Tax – A lot of onshore structures and free zones provide complete exemption, which increases profitability.

2. In free zones, 100% foreign ownership – In contrast to many other jurisdictions, maintain full equity without a local sponsor.

3. Strong Legal Structure – Clear regulations safeguard the rights of shareholders, investors, and intellectual property.

4. Ease of Doing Business – With its streamlined e-services and one-stop-shop government portals, Dubai scores highly on the ease of company registration scale.

5. Markets & Talent Access – In addition to being close to South Asia, Europe, and Africa, more than 200 different nationalities coexist.

With these benefits, company formation in Dubai is about more than just creating a legal entity; it’s about accessing a vibrant, growth-oriented ecosystem.

Step 1 – Choose the Right Company Structure

Dubai provides a number of business cars. Your decision is influenced by elements such as ownership, liability, business operations, and geographic reach –

| Structure | Ownership | Liability | Ideal For |

| Limited Liability Company (LLC | Up to 49% foreign (onshore) | Limited to share capital | Trading firms, consultancies, SMEs seeking onshore presence |

| Free Zone Company (FZC/FZE) | 100% foreign | Limited to share capital | Export/import, logistics, IT, media, e‑commerce in free zones |

| Branch of Foreign Company | Same as parent company | Parent company | Established international brands expanding into UAE |

| Professional Service License | 100% foreign (with local service agent) | Owner personal | Consultants, freelancers, legal/accounting professionals |

Any successful plan for a company formation in UAE is built on the foundation of choosing the best structure.

Step 2 – Select Your Business Activity & Jurisdiction

The jurisdictions of Dubai are divided into three groups –

1. Mainland (Onshore) – The Department of Economic Development (DED) oversees mainland (onshore) regulations. Provides access to the local market, although LLCs frequently need a 51% local sponsor.

2. Free Zones – More than 30 free zones (such as DMCC, JAFZA, and DAFZA) that serve industry-specific requirements (finance, media, and trading). Allow for complete foreign ownership, capital repatriation, and streamlined customs processes.

3. Offshore – Jurisdictions for managing intellectual property, holding assets, and conducting international trade without onshore operations, such as RAK ICC or JAFZA Offshore.

Which license you need to apply for—commercial, industrial, or professional—depends on the type of business you have chosen. Precise specifications guarantee seamless company registration and adherence to regional laws.

Step 3 – Reserve a Trade Name & Initial Approval

1. Trade Name Reservation – Send the DED or the appropriate free-zone authority up to three suggested names. The UAE’s naming guidelines must be followed; no references to religion, profanity, or well-known international organizations may be included.

2. Initial Approval Certificate – The government’s approval of your suggested activity and ownership structure is confirmed by this initial green light. Until the license is granted, it does not allow you to begin trading.

You can proceed with leasing space and completing the necessary paperwork once you have this approval.

Step 4 – Lease Office Space & Secure Ejari (for Mainland)

Companies operating on the mainland are required to lease a physical office or retail space and use the Ejari system to register the agreement with the Rental Dispute Centre (RDC). Usually, free-zone organizations provide flex desks or warehouse spaces that are customized to meet your needs. Free zones have different requirements for offices –

When you apply to register your business, your tenancy agreement acts as proof of address.

Step 5 – Prepare Memorandum & Articles of Association

Key documents include –

These need to be notarized at a public notary and written in Arabic and English (or translated by a qualified translator).

Step 6 – Submit Final Documents & Pay Fees

Compile all documentation –

Receive your Trade License, the foundation of your lawful operations, after submitting to the DED or free-zone authority and paying the license, registration, and registration fees.

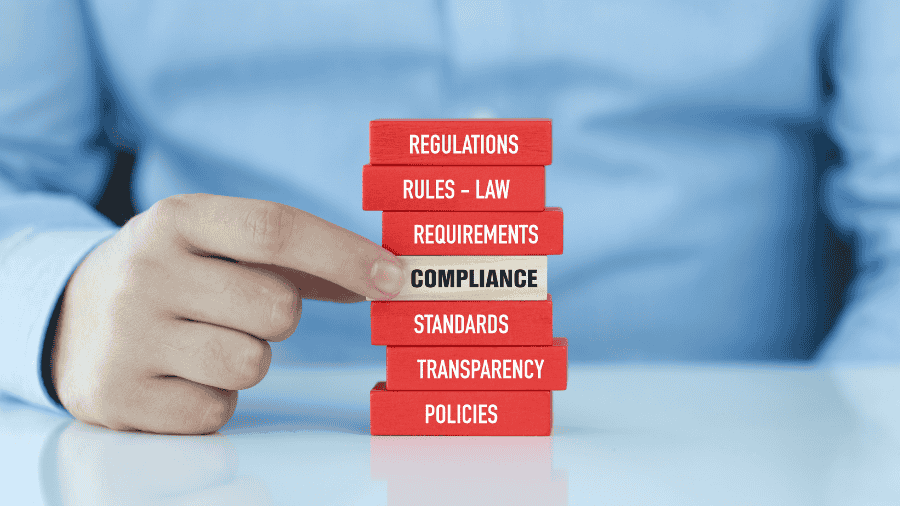

Respecting Anti Money Laundering UAE laws is a must. The following is mandated by the UAE’s Federal Decree-Law No. 20 of 2018 and subsequent Cabinet Decisions –

1. Customer Due Diligence (CDD) – Confirm each client’s risk profile, beneficial ownership, and funding source.

2. Record-keeping – Keep CDD files and transaction records for at least five years.

3. Risk-Based Approach – Put policies in place that are commensurate with the inherent AML/CFT risks of your company.

4. Reporting Suspicious Transactions – Notify the UAE Financial Intelligence Unit (FIU) of any suspicious transactions within the allotted time frame.

AML procedures are essential to sustainable company formation in Dubai since noncompliance can lead to severe fines, license suspension, or criminal liability.

It can be intimidating to navigate the complexities of company formation in the United Arab Emirates. Arabian Wingz can help with this –

1. One-Stop Consultation – Evaluate your business plan and suggest the best jurisdiction and organizational structure.

2. Document Preparation & Translation – Secure translations, process notarization, and draft MOA/AOA.

3. Licensing & Approvals – Managing trade-name reservations, initial approvals, and final license submissions are the responsibilities of licensing and approvals.

4. PRO Services – issuing Emirates IDs, labor cards, immigration approvals, and visa processing.

5. Continuous Compliance – Create CDD templates, set up AML procedures, and communicate with FIU on your behalf.

Arabian Wingz gives you a committed partner who is knowledgeable about every aspect of company registration, allowing you to concentrate on your main business plan.

After obtaining your trade license, take into account –

1. Investor & Employee Visas – Apply for UAE residency visas for employees and shareholders who are connected to your business.

2. Corporate Bank Account – Board resolutions, a trade license, and proof of address are required by UAE banking. Arabian Wingz can put you in touch with banking partners who are used to working with clients from around the world.

3. Import/Export Code – Register with Dubai Customs and get an E-directory code if your company trades internationally.

4. VAT Registration – Businesses must register for VAT with the Federal Tax Authority (FTA) if their taxable supplies total more than AED 375k per year.

As you grow, these actions guarantee regulatory compliance and operational preparedness.

Company formation in Dubai is a calculated decision that opens up market access, tax benefits, and international recognition. Every stage requires accuracy and knowledge, from selecting the best corporate structure and jurisdiction to becoming proficient in the UAE’s anti-money laundering regulations. You will receive end-to-end assistance by working with Arabian Wingz, which will turn difficult company registration obstacles into smooth accomplishments.

Are you prepared to use Dubai as a launchpad for your business? Make the first move toward a successful business in the UAE’s most important economic center by getting in touch with Arabian Wingz right now.