FTA announces Corporate Tax Registration Deadline – 90 days from Date of Incorporation/MOA. AED 10k penalty for late registration.

Tax planning and compliance have become essential in the current globally interconnected economy for both individuals and companies. Among all the compliance factors, the Tax Residency Certificate comes across as a crucial one.

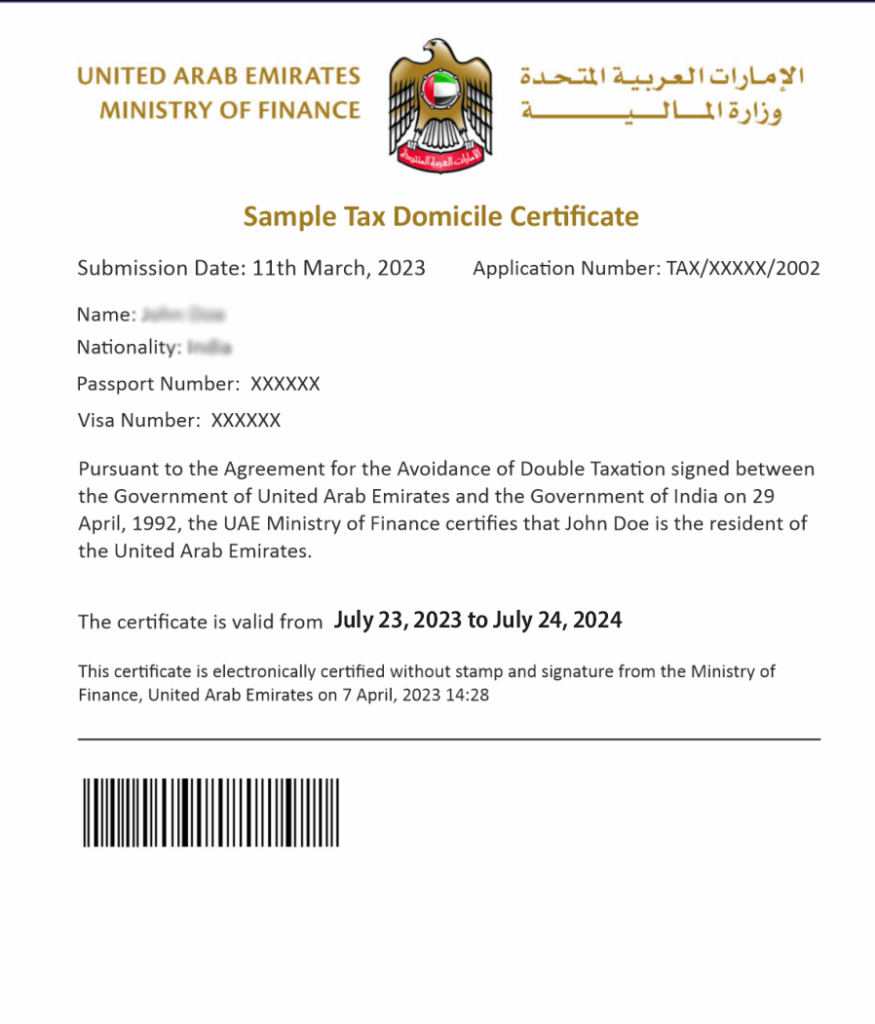

The Tax Residency Certificate (TRC) is one of the most critical documents that can help you easily manage your international taxation issues. TheTRC certificate Dubai, UAE, assists in demonstrating your tax residency in the UAE and allows you to gain benefits under the double taxation avoidance agreements (DTAA), which are in place between the UAE and other countries.

Obtaining a TRC can be a significant financial and legal advantage, whether you are a company located in the UAE or an individual working or investing in the country. However, the whole process of application involves providing the right documents as well as knowing the eligibility conditions.

The following blog will present to you all the necessary information related to the TRC application documents, requirements, process, and benefits of getting it.

A Tax Residency Certificate UAE is an official document issued by the Federal Tax Authority (FTA) of the United Arab Emirates. It confirms that a person or business is a UAE tax resident.

This certificate is used primarily to claim tax benefits under the Double Tax Avoidance Agreements (DTAA) that the UAE has with other countries. The UAE tax certificate is valid for one year and can help to avoid being taxed twice on the same income. Both residents and registered businesses in the UAE can apply for a TRC.

Having the right paperwork on hand is crucial for a successful and seamless application process for TRC UAE. However, if you are confused about the documents, you can get assistance from reliable experts like Arabian Wingz. Here is a complete overview of key documents required for both individuals as well as companies:

For Individuals

The comprehensive TRC application documents for individuals include:

For Businesses

Arabian Wingz, one of the leading business setup consultancy experts in the UAE, can help businesses with the collection of the right documents. Here is a complete list of required documents for businesses for the TRC application procedure.

All these TRC application documents are essential and must be in Arabic or an official translation.

You can apply online through the Federal Tax Authority (FTA) portal to receive the tax residency certificate UAE. Here are the key steps to be followed:

You can apply TRC UAE more effectively if you follow these steps.

Getting a TRC certificate Dubai, UAE, offers numerous advantages. Here’s why it’s worth applying:

Getting a TRC certificate Dubai, UAE, is a strategic step for people wanting to avoid double taxation and, at the same time, boost their financial profile. In either case of an individual earning or a business being registered, the certificate confirms the taxpayer’s residency in the UAE and permits the taxpayer to benefit from the global tax treaties to the fullest extent.

Despite the UAE tax certificate requirements making the process look challenging, having your documents ready can make it less complicated.

However, Arabian Wingz, a reliable business consultant in the UAE, provides complete support for acquiring your Tax Residency Certificate. Our experts deal with every aspect, from document preparation to final submission, with accuracy and professionalism.

We do not allow any paperwork or delays to hinder your financial goals. So, get in touch with Arabian Wingz and obtain your TRC certificate Dubai without any hassle. Visit our website or make a call to begin your application journey now!

1. Who is eligible to apply for a TRC in the United Arab Emirates?

Eligible parties include people who have been in the UAE for more than 183 days, as well as businesses that are registered and operating in the UAE.

2. What is the validity period of the TRC?

The certificate is valid for a year after it is issued.

3. How much does it cost to apply for TRC?

For individuals, the application fee is approximately AED 100; for businesses, it may be AED 1,000 or more.

4. Can I get a TRC if I don’t have a tenancy contract?

No, a valid UAE address proof, like a tenancy contract or title deed, is mandatory.

5. How can Arabian Wingz help me with a Tax Residency Certificate?

Arabian Wingz offers professional assistance in preparing documents, submitting your application, and ensuring smooth approval of your TRC certificate in Dubai.