FTA announces Corporate Tax Registration Deadline – 90 days from Date of Incorporation/MOA. AED 10k penalty for late registration.

In the world of global finance and mobility, transparency about where you pay tax is definitely crucial. For people and corporations running out of the United Arab Emirates, and particularly Dubai, the Tax Residency Certificate UAE has become an indispensable document.

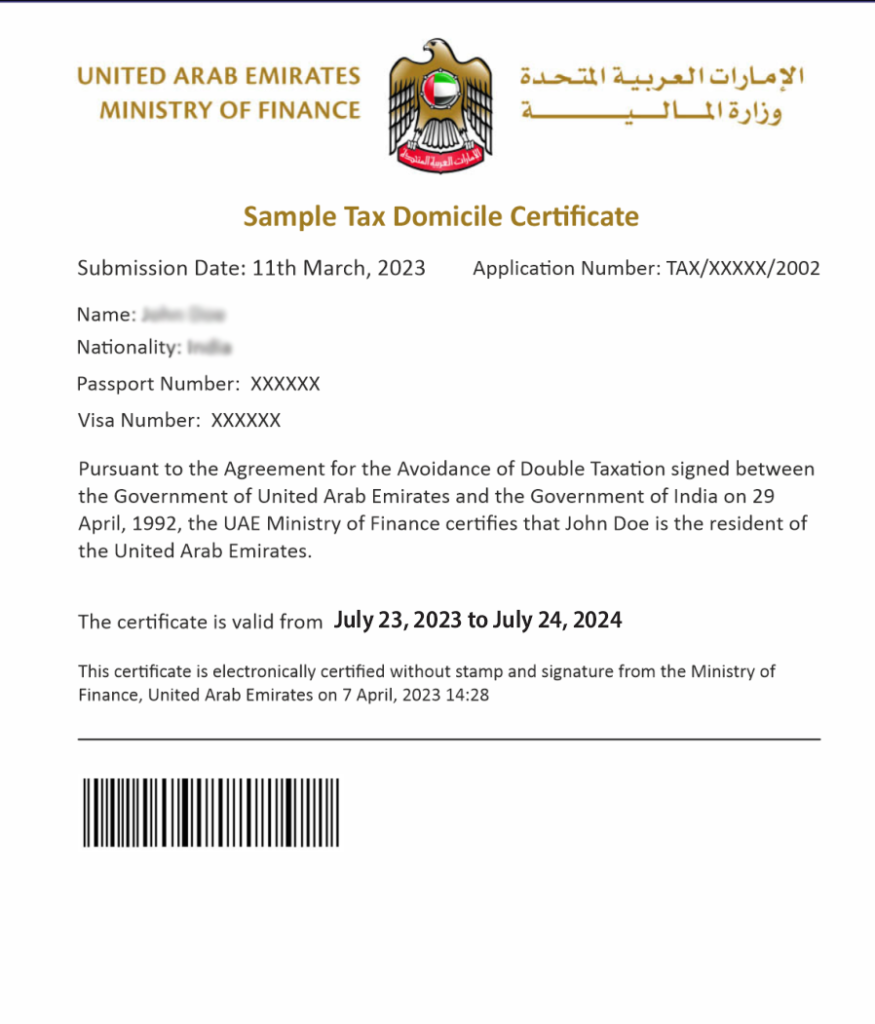

Also renowned as the Tax Domicile Certificate in the UAE, this official document is your legal protection against paying taxes twice on the same income and a crucial tool for proving your financial existence internationally.

As the UAE’s tax environment grows, specifically with the introduction of Corporate Tax and stricter global adherence, the rules for getting the UAE tax residency certificate are becoming more particular in 2026.

A Tax Residency Certificate (TRC) is an official document issued by the UAE’s Federal Tax Authority (FTA) or Ministry of Finance, confirming an individual’s or company’s tax residency status in the UAE. This certificate is essential for leveraging the UAE’s extensive network of Double Taxation Avoidance Agreements (DTAAs) with other countries, which helps to avoid paying taxes twice on the same income.

The main objective of the TRC is to permit the holder to leverage the Double Taxation Avoidance Agreements (DTAA) that the country has signed with more than 135 nations globally.

1. Avoid Double Taxation – With a TRC, income gained outside the United Arab Emirates could possibly be taxed both in the nation where it was gained and in the nation of your nationality or previous residence. The TRC proves your tax home in the UAE, permitting you to claim tax relief in the foreign nation under the DTAA.

2. Proof of Tax Domicile – Banks, foreign investment funds, and other financial institutions require extremely demanding formal evidence of a person’s or a company’s tax residency to adhere to global rules, such as the Common Reporting Standard.

3. Established Economic Substance – For corporations, the TRC is vital evidence that the business is definitely handled and controlled from within the United Arab Emirates and isn’t only a “Shell Company”.

The criteria for getting the tax residency certificate UAE are different for people and corporations, and these rules have become stricter to align with international standards.

For Individuals –

To get a tax residency certificate Dubai or the UAE, people should show a substantial and verifiable link to the Emirates.

Route 1 – 183-Day Rule – To obtain the certificate, you must be physically present in the UAE for at least 183 days within the 12-month period. An Immigration Entry and Exit Report is required, which can be obtained from the Federal Authority for Identity and Citizenship (FAIC).

Route 2 – 90-Day Rule (Alternative) – To meet the requirements, you must be in the UAE for at least 90 days and satisfy one of these criteria –

Required documents include –

Route 3 – Centre of Vital Interests – This situation is less common but applies if the UAE is the individual’s primary or usual place of residence, as well as the center of their financial and personal interests, even if they spend less time there. Evidence can include family ties, bank accounts, investment management, and involvement in social or cultural activities in the UAE.

For Companies –

The demands for a corporation to obtain a tax residency certificate require paying attention to showing real economic activity and management within the United Arab Emirates.

1. Time in Operation – The company should have been integrated or formed for at least one year before making an application for the certificate.

2. Physical Presence & Management – The company’s main management and control should be in the United Arab Emirates. This means –

3. Financial Documentation – The company should present audited financial statements for the relevant year, ready by an accredited audit company in the United Arab Emirates.

4. Corporate Tax TRN – Initiating in 2026, holding a legal Corporate Tax Registration Number is compulsory for companies applying for a Tax Residency Certificate.

The complete application procedure for the UAE tax residency certificate is handled online through the Federal Tax Authority’s digital platform, Emara tax.

1. Eligibility and Documentation Preparation

Before you log into the portal, your success hinges on appropriately collecting the necessary documents. Wrong documentation is the top reason for rejection or delays.

Documents for individuals –

Documents for companies –

2. Online Application through Emara Tax Portal

3. Payment and Submission

4. FTA Review and Issuance

Handling the complication of the tax residency certificate demands can be difficult, particularly with the tighter rules introduced in 2026. A small mistake or missing document, like a wrong entry/exit report or a non-compliant Ejari, can cause weeks of delays and rejection.

This is where specialized tax and corporate services providers, like Arabian Wingz, become invaluable.

1. Pre-Application Vetting – Arabian Wingz performs a complete review of your documents against the FTA’s current 2026 checklist, making sure every detail, from the 183-day count to the business license validity, is ideal before submission.

2. Entry-Exit Report Management – They help in getting the right official immigration entry and exit report, which is the most typical pitfall for individuals.

3. Compliance Check – For corporations, they examine adherence to Economic Substance Regulations and make sure the Audited Financial Statements fulfill all crucial norms for the TRC application.

4. Seamless Submission – They manage the whole online application procedure on the Emara Tax portal, handling the submission and liaising with the FTA on your behalf to decrease processing time and sidestep rejections.

Involving an expert service makes sure your application for a tax residency certificate Dubai or the broader UAE is strong, timely, and completely adherent to the growing tax landscape.

The tax residency certificate UAE is typically legal for one calendar year from the beginning date of the 12-month duration it covers.

1. Not Retroactive for the Future – You can’t apply for a TRC for a future duration that hasn’t yet begun. The certificate always covers a duration that is either in the past or the present year.

2. Renewal – The procedure is similar to the initial application. You should reapply on the EmaraTax portal, presenting updated documents to prove continued tax residency for the new 12-month duration.

As the United Arab Emirates establishes its position as an international financial and business hub, the tax residency certificate 2026 is more than only a management demand; it is a crucial part of international tax planning.

It is your official declaration to the world that the UAE is your real tax domicile certificate UAE, securing your income from unwanted taxation and boosting your credibility with global financial units.

By familiarizing yourself with the updated criteria, particularly the strict residency and documentation requirements for 2026, and by collaborating with experts like Arabian Wingz, you can effectively navigate the application procedure. This will help you secure your financial future in the thriving environment of the UAE.

1. What is a Tax Residency Certificate (TRC)?

A TRC is an official document from the UAE government that shows you are a tax resident of the UAE for a certain 12-month period. It helps you avoid paying tax twice in two different countries.

2. Who issues the TRC in the UAE?

The Federal Tax Authority (FTA) issues the Tax Residency Certificate through its online system called EmaraTax.

3. Why do individuals need a TRC?

Individuals need a TRC to prove they live in the UAE for tax purposes. It helps them avoid double taxation and provides official proof of their tax home for banks, investments, or foreign authorities.

4. Why do companies need a TRC?

Companies need a TRC to show that their business is truly managed from the UAE. This helps them avoid paying tax twice and follow international rules on economic substance.

5. How long must I stay in the UAE to qualify for a TRC?

You must stay 183 days in the UAE, or at least 90 days if you have a home, job, or business license in the UAE. You must show an official entry/exit record.