FTA announces Corporate Tax Registration Deadline – 90 days from Date of Incorporation/MOA. AED 10k penalty for late registration.

The goAML system was developed by the United Nations Office on Drugs and Crime to combat money laundering UAE and the financing of terrorism. It is deemed an incorporated system utilized by the financial intelligence unit to receive, research, and allocate suspicious transport reports in a quick and effective way.

A huge number of financial intelligence units globally are presently utilizing it, and the UAE is the first Gulf country to apply this contemporary system. goAML registration is required for entities falling under the AML regulations to access and use the platform effectively.

If you are an adherence officer, the goAML is the platform where you can handle your reports and oversee suspicious activity reports in your association. If you have not registered yet or have any associated questions, below we explain certain important things that will clear your confusion.

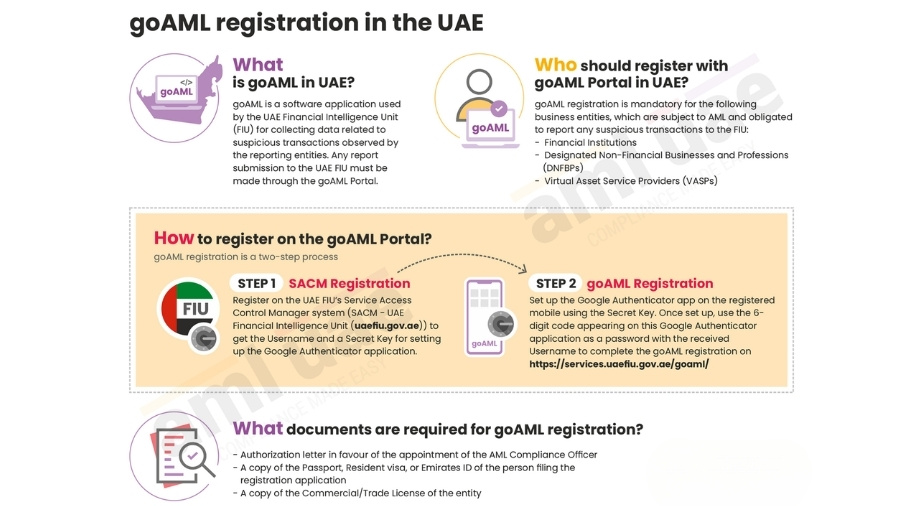

The goAML is a software application utilized by the financial intelligence unit (FIU) of the UAE to curb money laundering and terrorist financing. The goAML ownership lies with the United Nations Office on Drugs and Crime. It is one of the strategic reactions of the UNODC to money laundering and terrorist financing.

The goAML platform takes care of data collection, administration, research, documentation, workflow, and statistical requirements of the financial intelligence unit of the United Arab Emirates. The goAML platform is utilized by the FIU of the UAE to collect details and information about secret transactions, including money laundering.

goAML registration in the UAE is the procedure by which companies and financial units in the United Arab Emirates sign up on the goAML platform to report suspicious financial movements. This registration is compulsory to make sure adherence to AML regulations in the country.

To access the anti money laundering UAE system and begin presenting reports in the country, you will have to utilize the goAML login page to reach your credentials safely. The goAML UAE login page delivers a simple interface for authorized users to enter the system and complete regulatory needs.

To curb financial crimes, certain companies in the UAE are needed to perform anti money laundering UAE registration. goAML is a cutting-edge platform used by regulated units in Dubai, UAE, to fight money laundering and make sure regulatory adherence.

The regulated companies subject to AML compliance UAE are needed to hold goAML reporting, comprising a suspicious activity report and a suspicious transaction report, to the Financial Intelligence Unit and the regulatory officials. Below are the AML-regulated companies that need to register on the goAML platform of the UAE –

If you fail in registration, it means you are not complying with Federal Decree Law No. (20) of 2018 and Cabinet Decision No. (10) of 2019. It is a serious problem. Fines may comprise –

Before accessing the goAML portal, you must register with the Sanctions and Compliance Monitoring (SACM) system.

After SACM registration:

You have to prepare some important documents. The authorities would not even view your application without basic documents. Most of what is necessary is standard business papers, but there are some AML-specific documents you will have to prepare in advance –

1. Business License – A legal commercial or professional business license for your company.

2. Compliance Officer Documents – Copy of passport, Emirates ID, and residency visa of the hired AML compliance UAE officer.

3. Authorization Letter – Signed letter authorizing the compliance officer to work on behalf of the business for AML tasks.

4. Organizational Structure – Common highlights of ownership, business activities, and business partners.

5. Contact Information – Precise contact number and email details for official communication.

6. Google Authenticator Setup – You will have to install the app on the phone of the compliance office for 2 factors authentication throughout goAML registration access.

7. Additional Licenses – Any industry-specific approvals or permits based on your business activity.

Some authorities may ask for additional papers based on the type of your business, so it is better to review them prior to any submission.

The United Arab Emirates has taken important moves to fight money laundering and terrorism financing. The goAML method is a crucial part of that aim. Companies need to take more responsibility by implementing strong AML Policies & Procedures, ensuring proper reporting, maintaining compliance records, and aligning their internal controls with regulatory requirements to prevent financial crimes effectively.

When you present a Suspicious Transaction Report, you are not accusing somebody; you are giving notification to authorities that something does not seem authorized. They will examine. You have completed your task.

The government of the UAE is not only inspiring companies to adhere. It is making it compulsory. More checks, stringent fines, and real-time supervision are all coming in 2026. If your business is not ready, you may face uncertainties, audits, or more destructive consequences.

Navigating anti-money laundering (AML) regulations can be complex, but it doesn’t have to be. At Arabian Wingz, we specialize in helping businesses across the UAE meet compliance requirements with ease and confidence.

Don’t go it alone. Partner with Arabian Wingz for expert guidance, stress-free goAML registration, and ongoing AML support.