FTA announces Corporate Tax Registration Deadline – 90 days from Date of Incorporation/MOA. AED 10k penalty for late registration.

FTA announces Corporate Tax Registration Deadline – 90 days from Date of Incorporation/MOA. AED 10k penalty for late registration.

FTA announces Corporate Tax Registration Deadline – 90 days from Date of Incorporation/MOA. AED 10k penalty for late registration.

Arabian Wingz simplifies the comprehensive process of acquiring your UAE Tax Residency Certificate with adequate speed and accuracy. We handle all documentation and legalities, ensuring full compliance with UAE regulations. Trust us to deliver a seamless, hassle-free experience from start to finish.

Contact Us

In this current world, individuals and businesses may reside in multiple countries, yet their tax residency is recognized in only one nation.

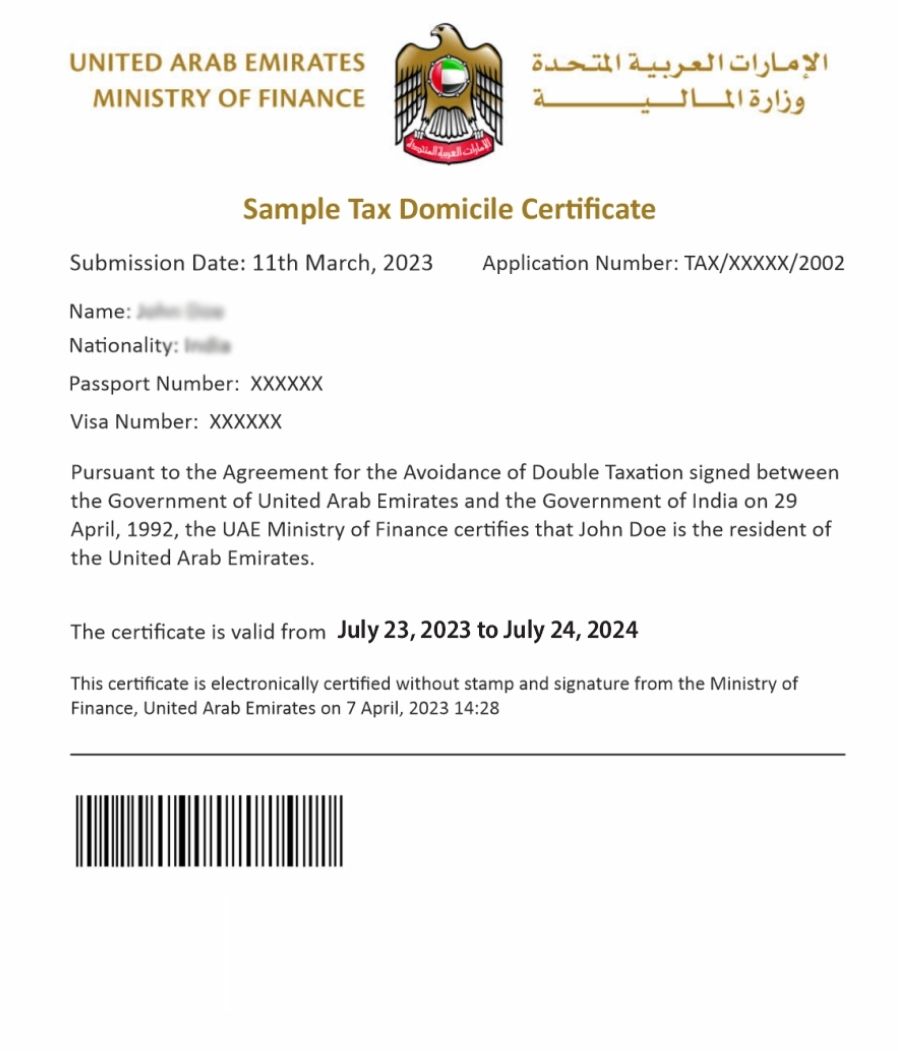

The Tax Residency Certificate UAE—also known as the Tax Domicile Certificate—serves as proof that you are considered a tax resident of the UAE. This means you pay taxes in the UAE and are exempt from taxation in other countries with which the UAE has established Double Taxation Avoidance Agreements (DTAA).

Both individuals and companies that fulfill certain criteria can get a Tax Residency Certificate in the UAE. With this certificate, any business income earned in the UAE or through overseas offices is taxed in the UAE, and the certificate can be submitted to the appropriate authorities in those other countries.

Tax Residency Certificate UAE exists in 2 general types:

1. Domestic TRC:

This is a certificate that is only for use in the UAE. It may be useful for local business and or government reasons, but holds no value for granting international tax treaty benefits.

2. DTA TRC:

This type of TRC certificate Dubai is critical for individuals and businesses who would like to take advantage of double tax treaty benefits. It shows that you are a resident of the UAE for tax purposes and intends to prevent you from being taxed in double tax situations when engaging with the countries in question.

The UAE has specific criteria that qualify individuals interested in obtaining a Tax Residency Certificate (TRC). Regardless of whether it is a domestic TRC or a TRC for Double Taxation Avoidance (DTA), the eligibility is different.

1. Domestic TRC:

Any person or business that resides or operates in the UAE is eligible to apply for a domestic Tax Residency Certificate UAE. This particular certificate is mainly intended for domestic use within the UAE. Even though domestic TRCs have a specific use, it is wise to consult with the Federal Tax Authority (FTA) to confirm how and where you may use the Tax Residency Certificate UAE.

2. TRC for DTA purposes:

This type of TRC certificate UAE, is used primarily for the purposes of benefiting from agreements with the UAE and other countries that sign agreements not to be taxed twice on the same income.

For Individuals

For individuals, the requirements for applying for a Tax Residency Certificate in Dubai or elsewhere in the country are:

For Businesses

For businesses, the eligibility requirements for applying for a Tax Residency Certificate are:

For people taking advantage of the Double Tax Avoidance Agreements (DTAA) that exist between the UAE and other countries, for example, India, they may also need to present a TRC certificate Dubai or otherwise in the UAE. The TRC certificate confirms tax residency in the UAE and makes sure that double taxation will not take place in the home country.

End-to-end expert guidance from documentation to compliance.

In the UAE, not everyone is required to obtain a Tax Residency Certificate. However, if another country requests evidence of tax residency to assist you in avoiding taxation, you are required to obtain a TRC. For example, if your home country requires proof that you are living and earning taxable income in the UAE before avoiding double taxation, just having a TRC certificate UAE is significant.

Before initiating the application for your TRC certificate Dubai, confirm your business or individual status meets the UAE’s TRC requirements.

Ensure your business is registered with the FTA and compliant with all applicable taxes, including VAT and Excise Tax.

Verify that your company adheres to all FTA regulations, particularly ESR, demonstrating substantial economic activity within the UAE.

Utilize the UAEPass digital identity for secure access to the FTA portal.

Prepare and upload all documents as defined by the FTA.

Pay the required TRC application fee through the FTA portal. This payment is vital for processing your application.

Track the progress of your TRC application through the FTA portal.

Upon approval, the TRC will be issued digitally and can be downloaded from the FTA portal.

The TRC certificate UAE is valid for 1 year, starting on the first day of the financial year you select on your application. By complying with the eligibility criteria and applying correctly, individuals and businesses may obtain their Tax Residency Certificate UAE and then apply the benefits of DTAs so that they are not taxed twice for the same income and follow the tax laws in both jurisdictions.

Once your TRC application is approved by the Federal Tax Authority (FTA), you can download your Tax Residency Certificate Dubai in the following way:

Quick and compliant TRC solutions tailored to your needs.

There are numerous significant benefits for both individuals and businesses when obtaining a Tax Residency Certificate (TRC) – also referred to as a Tax Domicile Certificate – in the UAE. Below are some of the main benefits of having a TRC certificate UAE:

The biggest benefit of obtaining a Tax Residency Certificate UAE is that you can take advantage of Double Tax Avoidance Agreements (DTAAs). The UAE has DTAAs with more than 76 countries. This means you cannot be taxed on the same income in both the UAE and your home country.

Companies engaged in international trade or importing or exporting goods can benefit from a Tax Residency Certificate from Dubai or the UAE in general. In some cases, holding a TRC may reduce or eliminate certain import/export duties, which simplifies and enhances the trading process.

A TRC certificate United Arab Emirates is a document issued by the Federal Tax Authority (FTA) that verifies you are a tax resident of UAE. This verification can have various uses, including opening bank accounts, fulfilling legal or compliance obligations, and confirming a tax residence to other tax authorities.

If you or your business operates in multiple jurisdictions, having a Tax Residency Certificate UAE can facilitate international transactions. A TRC certificate verifies tax residency status and, therefore, also minimizes tax complications and proves trustworthiness to foreign tax authorities and business partners.

Many countries apply a withholding tax on income of dividends, interest, or royalties paid to non-residents. However, if you have a TRC certificate Dubai verifying and proving you are a tax resident of the UAE, you may be entitled to reduced rates of withholding tax, according to the UAE’s DTAA with that country, which could save you or your company a considerable sum in taxes.

Obtaining a Tax Residency Certificate in Dubai or any emirate in the UAE demonstrates that your business takes tax-relevant laws and regulations seriously. This will influence your company’s reputation, especially with potential investors, business partners, and government departments.

While the TRC certificate UAE application process is straightforward, strict adherence to FTA regulations is crucial. Neglecting the Taxpayer Charter or related statutes can result in penalties or application delays.

Ensure all documents, including your Commercial Activity Certificate (CAC), VAT registration, and financial records, are current and accurate.

Maintain a record of timely tax filings, including VAT and Excise Tax returns. This indicates your obligation to tax obedience and is essential for maintaining a good reputation with the FTA.

Routine review of FTA guides, references, and public clarifications. These resources, accessible through the FTA’s Media Centre or E-Learning modules, provide essential updates and clarifications on tax-related matters.

Consider engaging a qualified Tax Agent or consultant. While self-application is possible, professional guidance can minimize errors, ensure accurate documentation, and save valuable time.

The Tax Residency Certificate UAE cost is divided into several key factors. Here is the comprehensive breakdown:

Handling the complications of tax regulations and ensuring proper company governance often requires expert guidance. A well-defined tax strategy provides an objective analysis of your business model and external influencing factors.

Arabian Wingz offers comprehensive services related to Tax Residency Certificate UAE, also known as Tax Domicile Certificates, in Dubai and the wider UAE. Our experienced team streamlines the application process, handling document preparation and certification to ensure timely completion.

Beyond the TRC certificate UAE assistance, we provide reliable and innovative solutions for all your accounting, bookkeeping, and auditing needs. For a detailed discussion on obtaining a Tax Residency Certificate in the UAE or any other accounting-related matter, please contact our expert accountants.

A Tax Residency Certificate, also popularly known as a Tax Domicile Certificate, is an official document issued by the Federal Tax Authority of the UAE. It certifies that a person or a corporation is a tax resident of the country for a particular period, permitting them to benefit from the Double Taxation Avoidance Agreements of the country.

Both companies and individuals can make an application for a TRC if they fulfill particular criteria. For individuals, this usually involves having a legal UAE residence visa and fulfilling a minimum stay requirement. For corporations, it typically requires the company to be legally formed and actively running in the UAE for a minimum of one year. Offshore businesses are usually not eligible.

The major advantage is avoiding double taxation. The TRC permits individuals and companies to take advantage of the country’s broad network of DTAAs with more than 140 countries. This can cause a reduction or exemption of withholding taxes on income, dividends, and royalties in a foreign nation, thus enhancing overall profits.

The Tax Residency Certificate is valid for one year from the start of the financial year for which it is provided. It should be renewed yearly by presenting a new application.

The documents needed differ slightly for companies and individuals –

A TRC application normally takes three to five business days to process after the Federal Tax Authority has received and verified all necessary and accurately completed paperwork.

Yes, businesses as well as individuals may apply. Although each has a unique application procedure and set of documents needed, the objective is always the same: to verify their tax residency status in the United Arab Emirates.

Yes, there is a minimum stay requirement for individuals. During the 12-month period for which you are applying for the certificate, you must have spent a minimum of 183 days in the United Arab Emirates. For people who live or work permanently in the United Arab Emirates and spend at least ninety days there, there are additional requirements.

The cost of a TRC varies. Depending on the details of the application and whether the business is tax-registered, the application fee can range from AED 568 to AED 1,842 for businesses and approximately AED 1,077.50 for individuals. A consultant’s professional service fees would be extra.

By making the entire TRC application process simpler, Arabian Wingz can help both individuals and businesses. To guarantee a seamless and prompt approval, they offer professional advice on eligibility, assist in gathering and preparing all necessary paperwork, manage correspondence with government agencies, and handle submission to the Federal Tax Authority.